“We can’t raise taxes, that will drive away jobs!” Such is the oft-repeated refrain uttered by Republicans at the Capitol. The implication is that it’s a direct correlation: high taxes means fewer jobs. But is that really the case? The statistics seem to say otherwise.

Not all states have been affected by the economic downturn in the same way. Some states have high unemployment, others relatively low. If taxes did drive away jobs, then you would expect that states with higher taxes would have higher unemployment, and vice-versa. So I decided to take a look at the data and see what it said.

Unemployment rates by state are easy to get from the Bureau of Labor Statistics. I found tax rates at the Tax Foundation, definitely not a liberal organization. I looked at data on both corporate tax rates as well as personal income tax rates, to see if one made more of a difference than the other. Many states do not have flat corporate or income taxes; in these cases, I chose the highest rate. Since Republicans argue that wealthier people are more likely to create jobs, it seems reasonable to therefore use the highest rate when doing comparisons. No adjustments were made for the point at which the top rate kicked in.

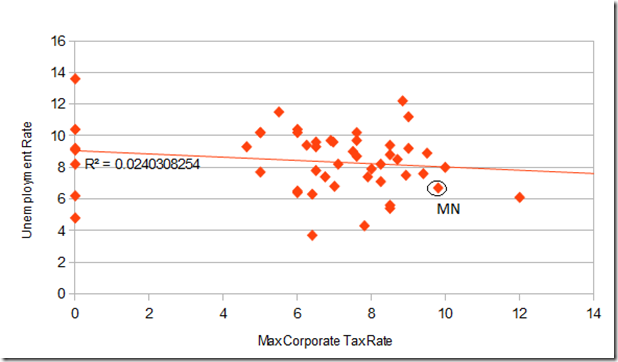

Doing a simple scatterplot for the corporate tax data versus unemployment rate resulted in this:

The line is the best fit trend line, and shockingly it shows that higher corporate tax rates seem to result in lower unemployment, although the correlation is almost non-existent. The column of dots on the Y-axis representing all the states with no corporate income tax shows a very wide spread in unemployment rates. Minnesota is actually doing better than the trend line would predict, with a lower unemployment rate than would be assumed from its corporate income tax rate.

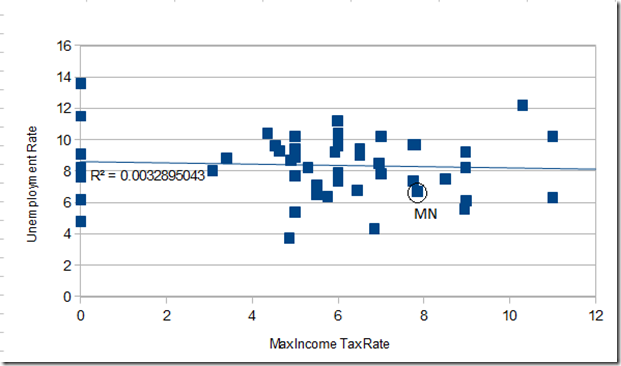

The income tax picture is quite similar:

Here again, the trend line suggests that higher income tax rates lead to slightly lower unemployment rates, although the correlation here is quite non-existent. Much like the corporate income tax rates, the cluster of no income tax states is widely dispersed, and again Minnesota is doing better than the trend line would predict.

This is certainly a quick-and-dirty analysis. The biggest flaw is that it is a snapshot in time, one that doesn’t show, for example, how changes in tax rates lead to changes in the unemployment rate. However, it is enough to show that the simplistic message of “High taxes=no jobs” is not quite accurate.