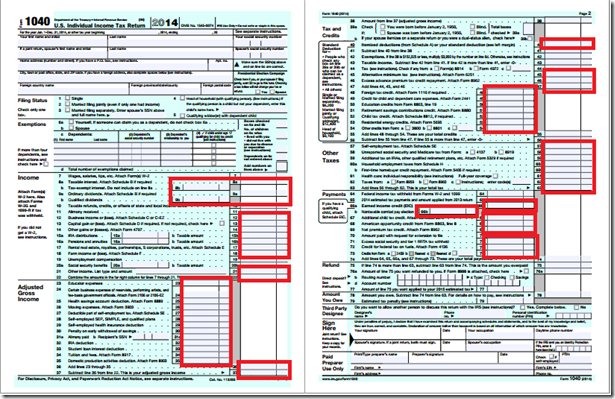

Long time no blog, eh? There’s been a lot of politicking going on lately, what with the presidential campaigns and debates and all, and lots of talk about tax plans. A favorite talking point about a tax plan is the argument that a flat tax will make taxes simpler. A flat tax is many things, first and foremost a great way to give the wealthiest in this country huge tax breaks, but making taxes simpler ain’t it. To illustrate, I’ll use the much-loved 1040 form. The first form is a quick and dirty attempt to show all the ways in which your income and taxes are adjusted through various schedules, deductions, credits, and so forth. These forms and adjustments are what make taxes so complicated and time-consuming. As you can see, it’s a lot!

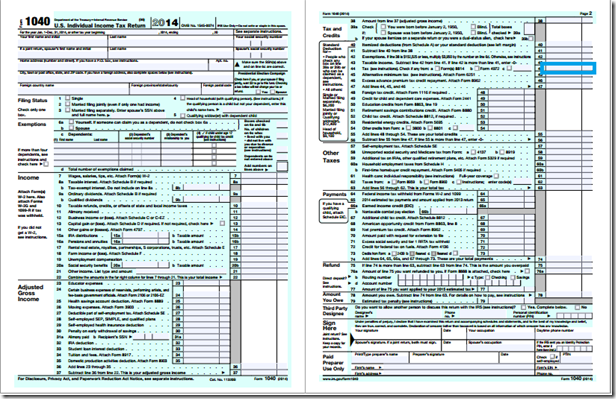

A flat tax, on the other hand, would make one change: it would alter the number you put on one line, namely the tax you owe (and if your income is really high, then that number is going to go way, way down):

I’m all for tax simplification. If you are honestly for it, though, that means you have to be willing to give up deductions and adjustments like the mortgage interest deduction, student loan deduction, and a lot of other popular things. Switching to a flat tax doesn’t make anybody’s taxes simpler, it just makes a lot of people’s taxes lower. A lot of particularly wealthy campaign donor’s taxes, to be precise.

I had no idea all of those things were iluncded in the income tax. I especially find it interesting that a single person, with a lower wage and no children, has to more than a person who makes a higher income. Granted the higher income option had children in the equation, but still. Crazy I would be spending more in taxes than a family. Interesting little evaluation tool.